Crypto trading in 2022 for beginners: a brief guide

Altcoins, i.e. all cryptocurrencies except bitcoin, have been attracting a lot of crypto-traders and crypto-investors – both experienced and beginners. The latter are certainly interested in the opportunity to make a fortune in a short time, but like any emerging unregulated market, altcoins carry a lot of risks.

The number of existing cryptocurrencies and tokens has long exceeded a thousand. With every new ICO, another token emerges. Some of them are quite promising, others have long made a name for themselves, while others are created solely to quickly enrich their developers. Altcoin exchanges are also present in the cryptocurrency market in huge numbers, so a novice trader risks getting completely lost in this variety.

All this makes cryptocurrency trading potentially profitable, but equally dangerous. Linix Foundation decided to answer the most common questions that beginners ask when they start working with altcoins.

What exchange to choose for crypto trading?

As noted above, there are a huge number of altcoin exchanges, some of which do not deal with fiat money at all, while others willingly exchange cryptocurrency for dollars. However, the demise of dinosaurs like Cryptsy and Mt.Gox has made the issue of exchange reliability quite pressing. Consider where and how to buy cryptocurrency and start trading.

Every exchange has its advantages and disadvantages.

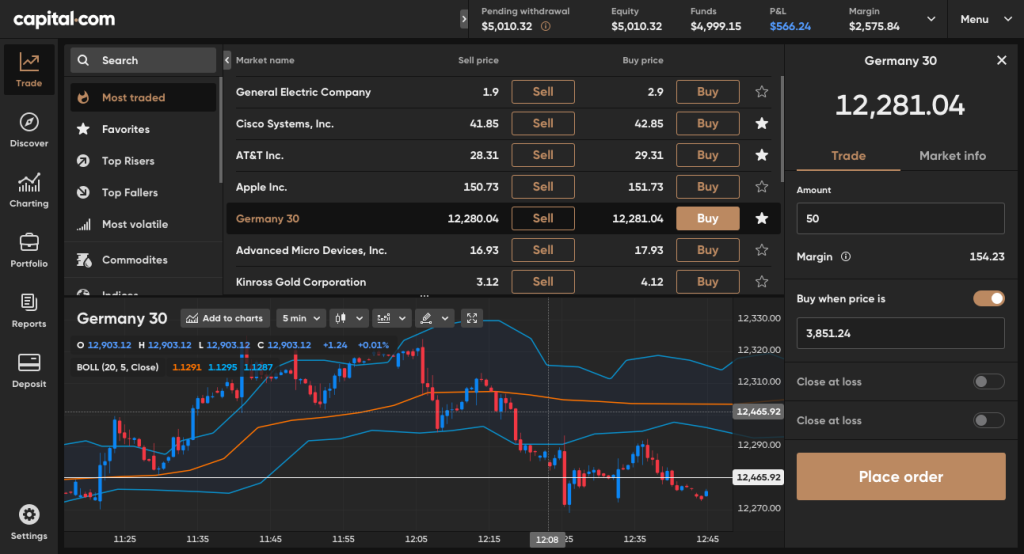

CAPITAL.COM

Thanks to its simple interface and contactable technical support, this platform has interested a large number of clients in a short period of time. The platform is designed in such a way that every user can get access to the latest news about the financial market and even get an expert opinion at any time. This feature distinguishes it from other platforms and allows clients to earn even more.

In addition, the platform boasts an excellent training base. Users can find a large number of video lectures, various materials and convenient feedback. A demo account is offered for practicing investing and strategizing. This platform covers a large number of different markets and more than hundreds of cryptocurrency investors have already shown confidence in it.

POLONIEX

Known among traders simply as “Polo,” it is one of the most famous altcoin exchanges offering a huge number of cryptocurrency pairs. It does, however, require a two-level verification process if the user intends to withdraw amounts above $2,000 per day. Many users criticize the exchange’s support team for its slowness. It was also repeatedly noted in the community that the exchange administration may be involved in some fraud, primarily related to Ethereum Classic, as well as managed pumps and dumps. But overall Poloniex has a pretty good reputation.

BINANCE

Judging by the volume of trading in digital assets, this exchange boasts the status of the largest in the entire financial sector. It offers more than a full range of cryptocurrency pairs available for trading. The exchange is very attentive to the selection of assets, taking care to ensure that users do not become victims of fraud. The service also allows virtual currency owners to receive passive income from assets by transferring them for lending or staking.

LIQUI

Liqui is a Kiev-based exchange with an international team. Unlike most of its counterparts, Liqui offers the creation of a deposit account on which funds are not frozen. On such an account, a percentage of the commissions charged by the exchange is accrued. Also, the exchange is noted for its rather strict management style: the administration states that users’ appeals to add altcoins will not be considered, because all such decisions are taken solely at the discretion of the management.

LIVECOIN

There are many altcoins on the exchange, and it is also possible to exchange cryptocurrency for rubles, dollars and euros. However, to do this, the user will have to say goodbye to anonymity and undergo a special verification. The pluses of the exchange include the ability to activate an order only if a certain price is reached, making it difficult to manipulate prices. Another obvious advantage is the storage of client funds in the cold wallets. In addition, users note that the exchange has excellent support service. Nevertheless, many of the altcoins presented on the exchange have very low liquidity and, therefore, may pose some danger to inexperienced users of cryptocurrencies.

BITTREX

This American exchange may be of interest to users who put security of money above user experience. In addition, Bittrex has probably the largest number of altcoins. Another significant plus of this trading platform – a simple enough procedure of verification, as a result of which you can increase the volume of the maximum withdrawal per day up to 100 BTC. That is significantly more than, say, Poloniex – the main competitor of Bittrex on the altcoin market. The disadvantages of the exchange include the slow work of the support service.

Crypto trading strategies: what and how much to invest in

Many novice cryptocurrency users are desperately looking for advice on what to invest in, and often find those willing to give such advice. However, professional traders argue that investing in something based solely on someone else’s statements is a rather rash decision, and they advise to do their own research on the coin they intend to spend their money on.

First of all, it is worth looking at the historical rate of the cryptocurrency in which you want to invest. Information about the rate and the state of the cryptocurrency market is freely available online, as well as in the rating of cryptocurrencies.

“Of course, competition is being felt, but the number of new projects (coins, tokens) is also growing, as well as the number of people willing to invest their money in these projects. There are a lot of them, because in order to make good money investing in bitcoin, you need to invest a lot, it does not grow by multiples in a short period of time. But with altcoins the situation is diametrically opposite. They can increase their value ten times in a few months, so it is sufficient to invest a few thousand dollars to earn a very serious amount of money, which is exactly what many clients use”, says Svetlana Geller, CEO of LiveCoin.

Preparing for investment involves not only studying forums and thematic media, but also reading the Whitepaper of the project. After all that, it is quite possible to consult with experts. If such precautions are taken seriously, it can significantly reduce the risk of losing all invested money.

Another question professional traders often hear from newbies is how much they should invest in this or that coin. Although it sounds somewhat provocative, there has long been a well-known answer to it.

Professional traders, exchange executives and just experienced altcoin players unanimously recommend to invest the exact sum the user can afford to lose.

The lack of regulation and deposit insurance makes crypto investing and crypto trading risky operations, and only the one who directly carries them out can be held responsible.

Exchanges and wallets

After buying cryptocurrency, a newbie immediately faces the problem of storing it.

The most reputedly reliable way is to withdraw funds to a cold wallet, such as a carefully protected flash drive, on which the records of your cryptocurrency savings are stored. Various methods can be used to protect against unauthorized access, from cryptographically generated passwords to biometric identification.

If the user is not going to make long-term investments, this method can be inconvenient because of the need for frequent access to such a wallet. If there is a need for relatively frequent cryptocurrency transactions, it makes sense to have a “hot wallet” – the online equivalent of a cold wallet. However, in this case, there is a risk of hacking and theft of funds.

For this reason, most experts recommend keeping small amounts in “hot” storage for day-to-day operations, while keeping the main funds in a “cold” wallet.

If the majority of cryptocurrency transactions are made on the exchange, it is more reasonable to keep funds directly on the exchange to avoid regular commission costs. This solution is both the most convenient and the most insecure way to keep cryptosavings, as exchanges can theoretically block the withdrawal of funds, be hacked or simply go bankrupt, as has happened more than once.

“The real security of clients’ funds, in our opinion, provides only storage of funds on cold wallets. Accordingly, you need to find out if a cryptocurrency exchange uses them before you start working with it. And the safety of clients’ accounts depends in 99% of cases on the clients themselves, because the hacks happen on the user side, so you need to take measures from your side, no matter what exchange you work with”, – says Svetlana Geller.

Svetlana also recommends using unique passwords and two-factor authorization with a separate device (usually a smartphone), as well as never keeping all funds in one place. Such security measures are offered by most existing exchanges.

Although most altcoins are positioned as trustless, they still need trust when it comes to the human factor. At the end of the day, the only justification for any investment, short-term or long-term, is faith in the object of that investment. Similarly, the user must trust the wallet he uses and the exchange on which he buys and sells cryptocurrencies. A trader’s success is determined by the degree to which this trust is justified.